With interest in blockchain and cryptocurrency on the rise, people are learning how to use blockchain to their advantage and looking for easier ways to buy Bitcoin. It is no surprise that some would-be investors are hopping on the bandwagon to know as much as they can about blockchain technology and how they can benefit from it.

But in blockchain, the truth can often be stranger than fiction. Up until 2022, it’s been a wild ride, and the journey ahead seems uncertain as well. Read on as we attempt to separate fads from facts about blockchain technology.

1. The first Bitcoin transaction was used to pay for a pizza

On the 22nd of May 2010, a person in Florida paid 10,000 bitcoins for two pizzas. This has been unanimously declared as the first transaction backed by blockchain. At that time, 10,000 bitcoins were equal to $40, making a single bitcoin worth less than half a cent.

If you had that much bitcoin today, you’d be sitting on top of $380 million.

2. Blockchain technology can allow people to have a digital ID

A decentralized digital identification database might be the solution for $1 billion people who are currently unable to verify their identity. Microsoft is working on a project (powered by blockchain) that provides each individual with a unique ID that they can use for travel, banking, and insurance-related purposes.

Even though blockchain technology is still in its nascent stages, many companies are willing to invest in it to develop it. As it continues to evolve, it will open up new business opportunities and possibilities.

3. The total number of bitcoins is limited

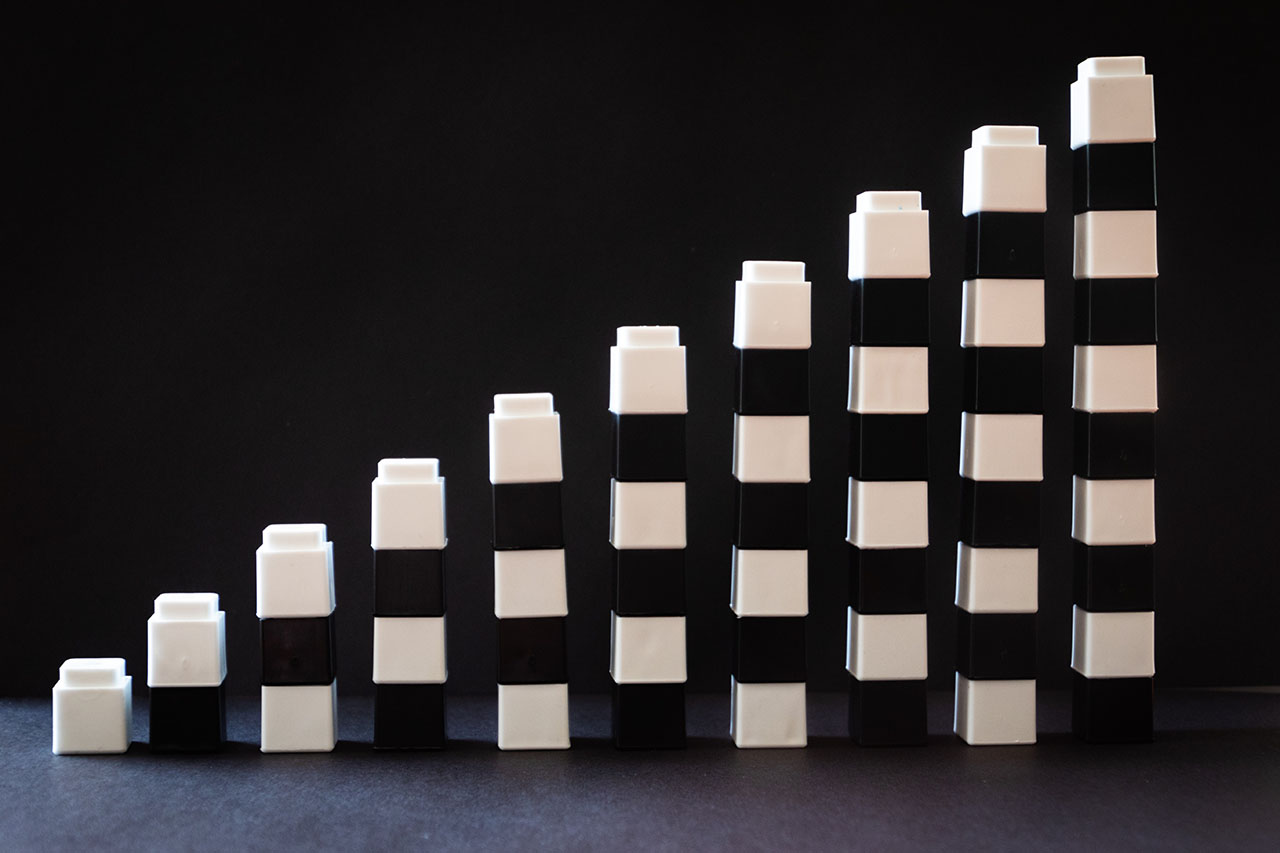

When the initial protocols for bitcoin were set up, its limit was set at 21 million. This policy dictates that you won’t be able to mine additional bitcoins after a certain point. When you’re completing transactions on the Bitcoin blockchain, you’re “mining,” and you receive your reward by a certain number of bitcoins.

The reward halves after every 210,000 blocks, which works out as approximately four years. As of 2022, some estimates state that 19 million bitcoins have already been mined. This means that the number of unreleased bitcoins is relatively low, which is also why the mining of bitcoins is still a popular activity.

4. The U.S Government can use blockchain to manage spectrum access

Spectrum refers to the airwaves or the signals over which every wireless transmission is made. The usage of the spectrum is highly regulated. Since the amount of spectrum available is limited, other wireless industries, cellular, television, GPS, and radio, must contend for its access.

On the other hand, the blockchain alternative allows individuals and companies to use it to communicate their spectrum needs. This could, in turn, lead to a lower transaction cost and a more efficient spectrum network.

5. Some coins powered by blockchain have more than one use

Some cryptocurrencies can be used just beyond their uses as a coin. One of these currencies is Ethereum, and it can be used for more than just sending currency or processing payments. Even though you can use Ether for transactions (given that it’s accepted), the technology isn’t used as a medium of exchange.

Ethereum can also be used to execute smart contracts, and it’s also utilized for the modern supply chain management. Moreover, other cryptocurrencies have also created their structure on the Ethereum network.

6. Some countries have banned cryptocurrencies

Not every country has allowed the use of digital currencies. For instance, Turkey doesn’t allow payments in cryptocurrency, while Nigeria has banned cryptocurrency exchanges altogether. One of the most recent and significant bans has been from China. China banned financial institutions so that they couldn’t provide crypto transactions to their customers.

However, it’s also important to remember that banning cryptocurrencies is practically impossible. Countries can, however, regulate access to various service providers and shut down all exchanges. Since one of the world’s largest economies has taken a defensive stance against crypto, the future does seem uncertain.

7. Companies can use blockchain to organize their shipping operations easily

Shipping documentation often takes days to complete, but with the help of blockchain, it can be completed within a minute. Moreover, the technology also can lower the costs of transporting goods across different continents. This can be achieved by integrating the data of several companies, be it manufacturers or shippers to a single platform.

Companies can also further incorporate the data of port authorities and insurance brokers.

8. Some traditional companies are profiting from the blockchain boom

With time, blockchain has increased the demand for powerful graphic processing units (GPUs). Until now, GPUs were primarily used for gaming, but they play an extremely pivotal role in mining bitcoins. For instance, GPU manufacturer NVIDIA has acknowledged that cryptocurrency and blockchain have considerably impacted their sales. This can also open up a world of new possibilities in the future.

9. Blockchain can be used to verify scientific claims

According to a recent post by Scientific American, blockchain technology could be used to certify and authenticate published research to reduce false claims and research errors. Approximately 2.5 million studies are published every year, and only a handful of them are authenticated. With help from blockchain, verifying data can be easy.

It can also make it easy to alter!

10. NFTs aren’t currencies

Even though NFTs are growing in popularity and are considered digital assets, they aren’t cryptocurrencies. They’re tokens, but they aren’t used as an exchange medium. Moreover, NFTs can’t be replicated or divided. Nowadays, NFTs are gaining popularity as an alternative asset similar to collectibles or artwork.

This is also how some people see them; artwork and digital collectibles could slowly grow in value. Official sources like the NBA TopShot also offer NFTs. These operate similarly to digital trading cards.

Conclusion

Blockchain opens up many possibilities for investing, digital collectibles, and several other avenues companies have just started using. That said, it’s also essential to understand the potential downsides since a new class of assets can pose a new barrage of risks!